If you’re eligible for duty drawback, you could be owed tens of thousands — even millions — in customs duty refunds. But there’s one thing that will make or break your claim: documentation.

Filing a duty drawback claim with U.S. Customs and Border Protection (CBP) isn’t just about proving you paid duties. You also need to show — clearly and consistently — how your imported goods were exported, used in manufacturing, or rejected and destroyed. That requires having the right documents, organized in a way that tells a complete story.

Without proper paperwork, your claim could be delayed, denied, or reduced — even if you’re eligible.

In this guide, we’ll walk through all the documents required for duty drawback, including:

- The core documents CBP requires for every type of claim

- Provision-specific records based on how your goods were handled

- Extra documentation for shared supply chains or complex claims

- Tips for organizing your documents and avoiding common filing mistakes

Whether you’re filing your first claim or improving your compliance setup, this article will help you stay audit-ready, maximize your refund, and avoid leaving money on the table.

Let’s dive in.

Why Documentation Matters in Duty Drawback

When it comes to duty drawback, documents are everything.

It’s not enough to say you paid duties or exported goods. To get a refund, you need to prove it — with paperwork that clearly supports your claim from start to finish. U.S. Customs and Border Protection (CBP) requires that every claim be supported by audit-ready documentation connecting:

- The imported goods you paid duties on

- The exported, destroyed, or rejected goods

- The relationship between the two

What CBP Looks For

When CBP reviews your drawback claim, they’re not just scanning forms — they’re asking:

- Did you really pay duties on these imports?

- Were those exact goods (or commercially interchangeable goods) exported, destroyed, or rejected?

- Do you have documentation that ties it all together?

If the answer to any of those is unclear or unsupported, your refund may be delayed or denied.

What Counts as Support?

There’s a difference between data and evidence. Customs expects to see:

- Entry documents and duty payment proof

- Export records with dates and carriers

- Inventory systems or lot tracking logs

- Invoices, production records, or destruction certificates

- HTS classification to support substitution claims

Customs doesn’t accept assumptions. If you can’t prove it on paper, it didn’t happen.

How Long You Need to Keep Drawback Documents

Even after you file, you’re not done. CBP requires you to retain all drawback-related documentation for at least three years after your claim is liquidated — which itself can take 1–4 years.

That means many claims require document retention for up to 7 years total.

Desk Reviews and Audit Risk

Most drawback claims are subject to desk reviews — where Customs asks for copies of specific documents you’ve referenced in your claim.

If those documents are:

- Missing

- Incomplete

- Inconsistent with what you submitted…

…CBP may reduce or reject your refund. Worse, repeated compliance issues can lead to broader audits or privilege suspensions.

The Bottom Line

Documents required for duty drawback claim isn’t just a box to check — it’s the foundation of your refund. Get this right, and you unlock cash flow with confidence. Get it wrong, and you risk waiting months (or years) for a payment that may never come.

Core Documents Required for All Duty Drawback Claims

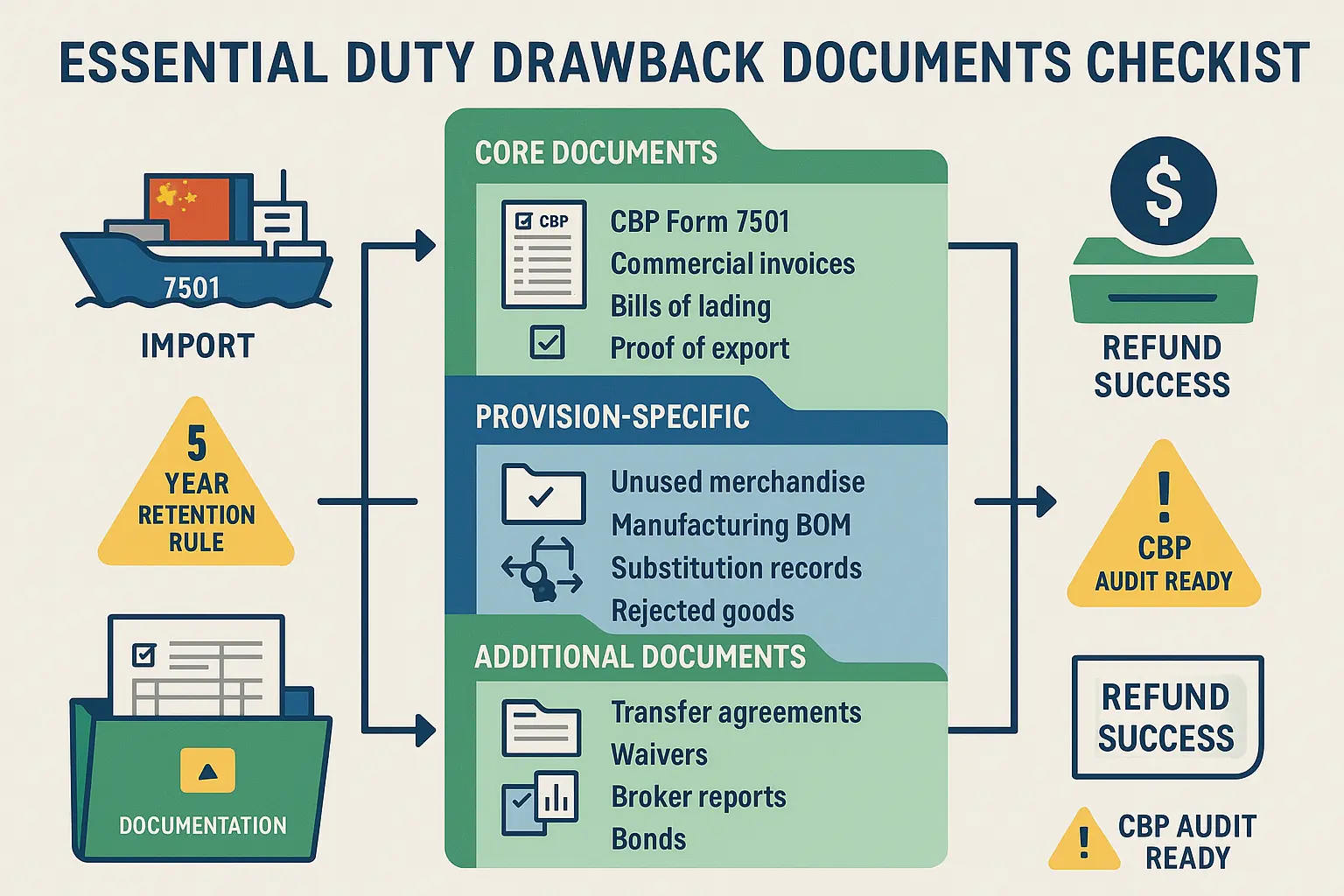

No matter what type of duty drawback claim you’re filing — unused merchandise, manufacturing, substitution, or rejected goods — there’s a standard set of documents required for claiming duty drawback.

These core records allow U.S. Customs and Border Protection (CBP) to verify that:

- You paid duties on imported goods

- Those goods were subsequently exported, destroyed, or returned

- You’re eligible to recover the duties under the law

Here’s what you’ll need.

1. CBP Form 7501 (Entry Summary)

This is the official record of your import — and proof that duties were paid. You must provide Form 7501 for each eligible entry included in your claim.

If you used a customs broker, they can typically pull this for you. Make sure the forms match the specific imports you’re claiming drawback on.

2. Commercial Invoices

You’ll need invoices for both your imports and your exports:

- Import invoices confirm the value, quantity, and product description

- Export invoices support valuation and prove the sale or transfer abroad

Invoices help CBP verify product identity, trace HTS codes, and validate quantities.

3. Bills of Lading or Air Waybills

These documents prove physical shipment of goods, including the carrier name, shipment date, and destination.

For export claims, make sure you have:

- Carrier-issued documentation

- Shipment tracking or delivery confirmation

- Consignee and destination details

4. Proof of Export

CBP must see clear evidence that the goods left the United States.

Acceptable proof includes:

- Signed bill of lading or air waybill from the carrier

- Customs export declaration (AES/EEI filing)

- Carrier tracking reports or booking confirmations

Tip: Make sure the proof shows both the date and fact of export.

5. Inventory or Production Logs

To connect your import to your export, you need traceability — especially if:

- Only part of your imports were exported

- You’re using substitution or manufacturing provisions

- You have high product turnover

Inventory logs, lot control systems, or ERP exports can all help establish this link.

6. HTSUS Classification Records

Especially important for substitution claims, you’ll need to show that your imported and exported goods fall under the same 8-digit HTS code.

If you’re claiming interchangeability, classification data helps CBP confirm you’re substituting like-for-like.

These Documents Apply to Every Claim

Whether you’re shipping sneakers, steel, skincare, or semiconductors — these documents are required for duty drawback.

In the next section, we’ll look at the provision-specific documents that may be required depending on how your goods were handled.

Provision-Specific Document Requirements

In addition to the core documents covered above, each drawback provision has its own unique documentation requirements. That’s because how your goods were handled — whether exported directly, used in manufacturing, or returned due to defects — changes what you need to prove.

Here’s a breakdown of the provision-specific documents required for duty drawback claims.

Unused Merchandise Drawback

If you imported goods and exported them without using or altering them, you’re filing under the unused merchandise provision. You’ll need to show that the goods:

- Were not used in the U.S.

- Were exported in essentially the same condition

- Can be traced back to the original import

You’ll need:

- Inventory or lot control records showing import-to-export tracking

- FIFO matching method documentation (if used)

- Photos or quality control logs (optional but helpful)

- Export packing slips or labels proving item condition

The key is traceability. Customs wants to see a clear path from the import container to the export shipment.

Manufacturing Drawback

If you used imported goods as raw materials or components in a product that was later exported, you’ll need to prove how and where that transformation occurred.

You’ll need:

- Bill of Materials (BOM) for the exported product

- Production records showing how much imported material was used

- Import receipts for the inputs

- Export documentation showing the finished good left the U.S.

- A manufacturing ruling or a letter of intent to operate under a general ruling

The more detailed your BOM and production logs, the easier it is to calculate your refund and defend your claim.

Substitution Drawback

Substitution allows you to claim drawback even if the exact imported good wasn’t exported — as long as the exported product is commercially interchangeable (same 8-digit HTS code).

You’ll need:

- Documentation of the HTSUS classification for both import and export

- Inventory logs showing volume, value, and timing

- Substitution logic or accounting method used (e.g., FIFO, LIFO, weighted average)

- Evidence that goods are functionally identical, even if sourced differently

CBP is strict about substitution claims — documentation must show that you followed proper classification and accounting methods.

Rejected Merchandise Drawback

This applies when you import goods that are damaged, defective, or noncompliant — and you either export them back or destroy them. CBP expects you to document both the rejection reason and the final disposition.

You’ll need:

- Return authorizations or rejection letters from the supplier

- Inspection or QA reports

- Photos showing defects or damage

- Proof of destruction (with CBP supervision) or export documentation

- Commercial invoice for the original shipment

Customs wants to see that the merchandise wasn’t fit for sale or use — and that you didn’t benefit from it domestically.

Additional Documents for Complex or Shared Claims

Not every duty drawback claim is straightforward. In many industries, the importer, exporter, and manufacturer aren’t the same entity — which means additional paperwork is required to prove eligibility and establish legal rights to file.

If you’re filing on behalf of someone else, part of a multi-party supply chain, or working through a customs broker, these are the documents you may need.

Transfer of Drawback Rights

If you’re not the importer or exporter of record — but you’re the one filing the claim — CBP will require written proof that the right to file has been transferred to you.

This usually comes in the form of a signed legal document stating:

- Which party is granting the rights

- What goods or transactions are covered

- The time period and terms of the transfer

This document is essential to avoid claim rejections in multi-entity arrangements.

Waiver of Drawback Rights

This is a more specific version of a transfer, often used when the exporter has no intention of filing a claim, and they grant those rights to the importer or manufacturer.

You’ll need:

- A waiver signed by the exporter

- Reference to the specific shipment or export window

- Confirmation that the exporter will not claim drawback themselves

This is especially important if you’re claiming drawback on exports handled by a 3PL, reseller, or overseas distributor.

Broker Summary Reports

Your customs broker may generate monthly or quarterly reports showing:

- Import activity

- Duties paid

- Entry summaries by HTS code

These reports can help validate Form 7501 data and are useful during documentation prep or CBP review.

Privilege Application Documents

If you applied for:

- Accelerated payment

- Waiver of prior notice

- Manufacturing rulings

…you’ll need to include copies of those approvals as part of your claim record. This shows that your claim is being filed under authorized privileges and speeds up the CBP review process.

Drawback Bond

If you’re requesting accelerated payment, CBP requires a drawback-specific bond to be on file. This is different from a standard importer bond.

You’ll need:

- A bond that covers the full value of your claim

- Issued by an approved surety

- Linked to your claim number or drawback program

The bond protects the government in case your claim is overpaid or challenged after payment.

When These Documents Apply

You may not need all of these for every claim — but if:

- You’re working through partners or third parties

- You’re not the importer or exporter yourself

- You’ve applied for privileges

- You want faster payment…

…you’ll want to make sure these additional documents are on hand and properly signed.

How to Organize Your Drawback Documentation

Having the right documents is only half the battle. To file smoothly — and respond quickly if U.S. Customs asks questions — you also need to organize your drawback documentation in a consistent, traceable, and audit-ready format.

This isn’t just about being neat. Poor organization can delay your claim, raise red flags, or even result in refund denials during a CBP review.

Why Organization Matters

CBP expects your claim to:

- Link each import entry to its corresponding export or destruction

- Clearly distinguish between eligible and ineligible shipments

- Be backed by evidence that matches what you filed electronically

A cluttered Google Drive or a half-filled spreadsheet won’t cut it. You need a repeatable system.

Best Practices for Drawback Document Management

Here are a few tips to keep your records organized and compliant:

Use Consistent Naming Conventions

- Include entry numbers, dates, product codes, and provision type in your file names

- Example: Import_Entry7501_042023_HTS6403_Unused.pdf

Group Files by Transaction

- For every claim, keep a folder that includes:

- Import documents (7501, invoice)

- Export documents (invoice, bill of lading, proof of export)

- Traceability docs (inventory logs, BOM, classification records)

Create a Master Index

- Maintain a spreadsheet that lists:

- Claim numbers

- Entry numbers

- Export dates

- Matching document file names or storage locations

Document Your Substitution Logic

- If you’re filing under substitution, keep a separate worksheet showing:

- HTS codes for imports and exports

- The accounting method used (FIFO, average cost, etc.)

- Dates and quantities matched

Digital Tools vs. Manual Systems

Manual document management (Google Drive, Dropbox, Excel) can work for small claims — but as your volume grows, it gets risky fast.

Consider:

- Using a document management system (DMS) with audit trails

- Integrating with your customs broker or ERP to automate record pulls

- Partnering with a tech-first duty drawback services provider (like Pax AI) that handles document extraction, matching, and compliance automatically

Don’t Forget Retention Rules

CBP requires you to retain all drawback-related documents for 3 years after liquidation. Since liquidation itself may take 1–4 years, that often means keeping your records for 5–7 years total.

Create internal policies around:

- Archiving

- Access control

- Backup and disaster recovery

What Happens If You’re Missing Documents

Let’s be honest: not every business keeps perfect records. If you’re realizing you don’t have all the documents required for your duty drawback claim, you’re not alone.

The good news? You may still be able to recover some refunds — or at least get compliant going forward.

Here’s how to assess the situation and figure out your next move.

Worst-Case Scenario: Total Gaps

If you’re missing:

- Proof of duties paid

- Export documentation

- Traceability between import and export

…then CBP likely won't approve your claim. Claims that can't be supported with real evidence are typically denied or placed into manual review limbo, delaying payment by months or even years.

Partial Records = Partial Claims

If you only have documentation for part of your import/export activity, you can file a partial claim.

Example:

- You imported 50 shipments last year

- You only have export records for 20 of them

- You can file drawback on those 20 shipments — and leave the rest out

Better to file a clean, well-supported partial claim than risk full denial by including undocumented entries.

Rebuilding Documentation (If Possible)

If you’re missing records but know the transactions happened, you may be able to reconstruct documentation by:

- Asking your customs broker for Form 7501s

- Pulling export data from your freight forwarder or carrier

- Recreating inventory logs from ERP or warehouse systems

- Collecting signed invoices or proof of return from suppliers

CBP may accept reconstructed documents if they are complete, consistent, and audit-ready.

If You Can’t Fix the Past, Fix the Future

If your historical documentation is too incomplete to justify a claim, focus on getting set up for compliant drawback moving forward.

That means:

- Putting systems in place to track imports and exports

- Standardizing document naming and storage

- Assigning responsibility across teams (ops, finance, compliance)

- Using a platform like Pax to automate data collection and storage

You might not be able to file for past imports — but you can absolutely build a foundation to capture all future refund opportunities.

If all this talk of CBP forms, inventory logs, HTS codes, and naming conventions sounds overwhelming — we get it.

That’s exactly why Pax exists.

We’ve designed our platform to handle all the messy parts of drawback documentation for you. From the moment you upload your files, we take over the matching, sorting, validating, and mapping — so you can focus on running your business while we focus on getting your refund.

Step 1: Upload Your Documents — Any Format, Any Volume

You don’t have to rename files, reformat spreadsheets, or organize by shipment. Just upload:

- ZIP folders, PDFs, CSVs, or Excel files

- Brokerage reports from your customs broker

- Export records from your ERP or freight forwarder

- Internal inventory or production logs

- Any privilege approvals or waivers you’ve received

Our system accepts all common formats and can ingest large document sets — no need to split by entry or provision.

Step 2: Pax AI Sorts and Extracts the Data Automatically

Once uploaded, our duty drawback platform:

- Extracts key data from each file (entry numbers, HTS codes, values, etc.)

- Matches import and export records by logic specific to your provision

- Flags gaps or inconsistencies in real time

- Automatically tags files to the correct CBP requirements

Instead of spending weeks manually reconciling records, you get a full document map in minutes.

Step 3: We Validate for Audit Readiness

Before we ever file your claim, our licensed in-house brokers run a validation check to ensure that:

- All required documents are present for each provision

- Quantities and HTS classifications align

- Dates and timelines fall within CBP’s 5-year window

- Substitution rules (if used) are properly supported

You’ll get a summary report showing what’s ready to go and what needs a quick fix.

Step 4: We File — and Keep Everything Archived for You

Once your documents are mapped and verified, we generate the full claim file and submit it electronically through ACE.

Afterward:

- Your documents are retained securely in your Pax account

- Everything is tagged and timestamped in case CBP requests a desk review

- You don't need to track down a single file — we have it all ready to produce

Ongoing Support, Minimal Effort

Even after filing, we'll:

- Help you respond to CBP inquiries

- Notify you when documents need updates or reauthorization

- Guide you through record retention best practices

Pax doesn’t just get you to the filing deadline — we keep you compliant for the entire claim lifecycle.

Conclusion: Right Documents, Real Refunds

If there's one thing to remember about duty drawback, it's this:

No documentation = no refund.

The documents required for a duty drawback claim aren't optional — they're the foundation of your eligibility. Whether you're filing under unused, manufacturing, substitution, or rejected merchandise provisions, U.S. Customs needs clear, audit-ready evidence that connects every import to an eligible export or destruction event.

Get your documentation right, and you unlock:

- Faster refunds

- Higher claim accuracy

- Lower audit risk

- The confidence to file again and again

Get it wrong, and you risk delays, denials, or leaving real money on the table.